Since the global financial crisis of 2008, Western financial markets have experienced steadily falling interest rates. Three years ago, they were close to zero. In 2020 the US benchmark interest rate, the 10-year treasury fell to 0.5 per cent, which meant that, after factoring in inflation, it was effectively nothing. The pattern was similar in Australia; the 10-year government bond yield fell to 0.8 per cent. Negligible interest rates might seem like a good way of managing short-term crises in the economy – and there was a great deal of concern in 2020 about the effect of the pandemic lockdowns – but any short-term gains come with a cost. The centrepiece of capitalist systems, to state the obvious, is the cost of capital – mainly, the interest rate on debt. There is also an implied cost of capital on equity, but this is more notional, whereas interest payments are far from notional. Take away the cost of capital and the central organising principle of the system goes away, leading to extreme distortions. These have been mainly evident in the ballooning of debt – which was cheap because of the low interest rates – in most Western economies and China. The picture is grim. According to the International Monetary Fund, in 2022 total world debt was 237 per cent of global GDP, or economy. In 2021, total US private and public debt was US$88 trillion, or 377 per cent of GDP. China’s debt is of similar proportions, and the country is printing money to keep its banking system and ail...

Blog

Related Posts

07

Feb

Being child-free is not selfish

Editor’s note: If you would like to submit a letter for possible publication, please email it to editor@rationalist.com.au. See our ...

14

Jan

Why do we think hard work is virtuous?

Not long ago, a relative of mine told me he had been working so hard in the yard that he’d “literally thrown up”. He didn’t offer this ...

09

Jan

Taking issue with the Catholic archbishop’s heartless, offensive ‘kill teams’ comments

Editor’s note: If you would like to submit a letter for possible publication, please email it to editor@rationalist.com.au. See our ...

02

Dec

What motivated the ‘cruel’ assisted dying bill?

Editor’s note: If you would like to submit a letter for possible publication, please email it to editor@rationalist.com.au. See our ...

19

Nov

Unlocking equity in property offers escape from Australia’s debt trap

One of the most important features of modern financial systems is rarely discussed and gets almost no attention. The failure to take it...

02

Nov

Leftism, a ‘mental illness’? Oh, Right!

Editor’s note: If you would like to submit a letter for possible publication, please email it to editor@rationalist.com.au. See our ...

07

Oct

A bridge to peace

Editor’s note: If you would like to submit a letter for possible publication, please email it to editor@rationalist.com.au. See our ...

09

Sep

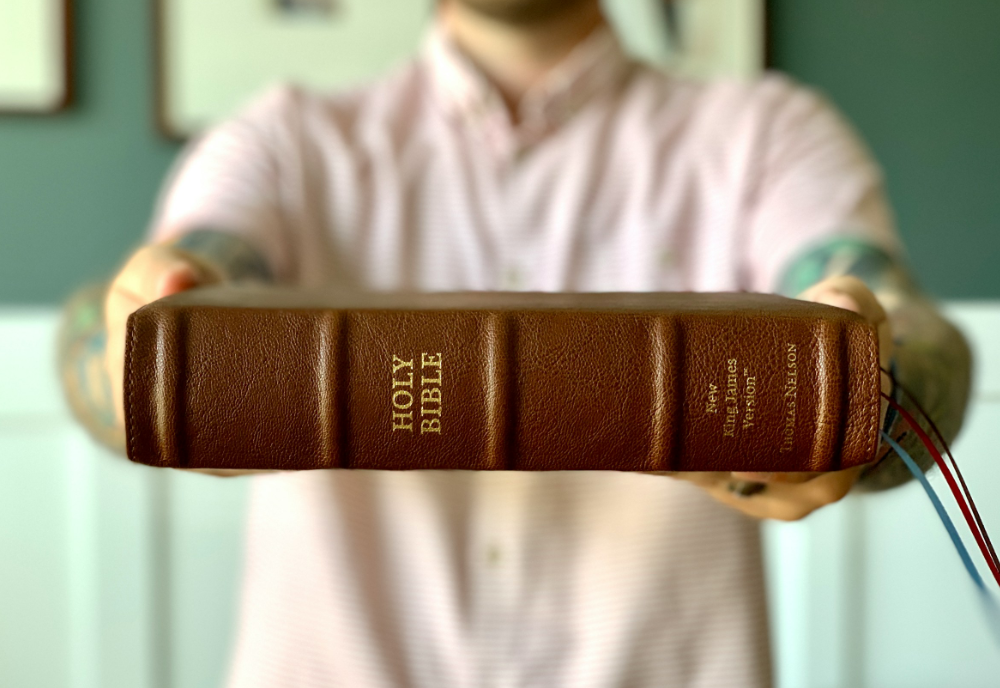

The price paid for usury

In major civilisations, bans on usury have been one of the most universal of principles.

Aristotle argued against making money from...

25

Aug

Criticising Israel is not ‘antisemitic’

Editor’s note: If you would like to submit a letter for possible publication, please email it to editor@rationalist.com.au. See our ...

24

Jul

End the government funding of faith workers

Editor’s note: If you would like to submit a letter for possible publication, please email it to editor@rationalist.com.au. See our ...

10

Jun

‘Heritage’ is no argument against change on parliamentary prayers

Editor’s note: If you would like to submit a letter for possible publication, please email it to editor@rationalist.com.au. See our ...

12

May

Will the Coalition ever learn to stop imposing religion on the public?

Editor’s note: If you would like to submit a letter for possible publication, please email it to editor@rationalist.com.au. See our ...